Oliver Belin has over 15 years of experience in supply chain finance and credit finance solutions. He has worked for numerous leading organizations notably in 2008, he founded Swiss Commercial Capital, a company specialized in trade finance solutions, which was successfully sold to Macquarie Bank. Oliver is the author of two books focused on Supply Chain Finance Solutions and is a frequent speaker on this topic.

Currently, he is the CEO of Calculum, a company that specializes in analyzing, optimizing, and negotiating payment terms. Under his tenure, Calculum had been recognized for its excellence in working capital and supply chain finance, winning several awards.

Oliver’s achievements demonstrate his position as a recognised thought-leader who is dedicated to advancing the field of Supply Chain Finance and we were delighted to sit down and learn more about the impressive capabilities on offer at Calculum.

Oliver, what is Calculum?

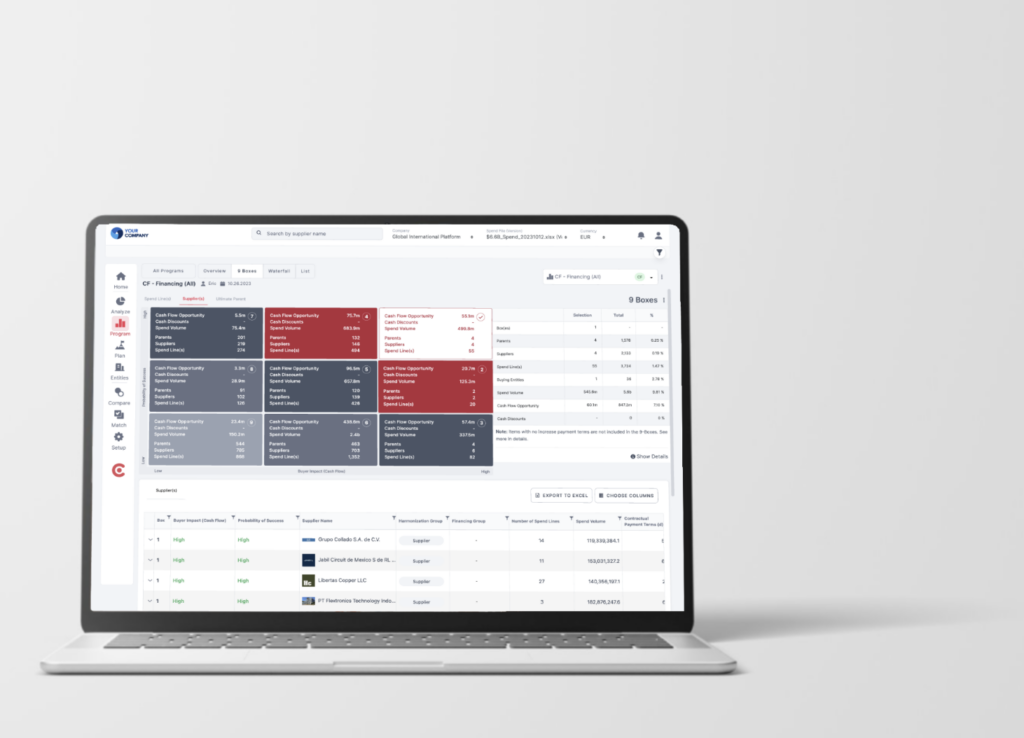

Calculum is an AI-powered Supply Chain Analytics Platform that unlocks working capital and generates billions in free cash flow.

Calculum provides insights to finance and procurement teams on their suppliers, allowing them to transform the way payment terms are benchmarked, negotiated, and optimized. The result is, on average, 8-11% in additional cash flow, considering ESG, credit ratings, and supply chain risk assessments.

Headquartered in Miami, with operations in Europe and South America, Calculum’s platform is a spinoff from the leading University of St. Gallen in Switzerland and is currently used by some of the largest companies in the world to gain a competitive advantage.

What issue does your solution solve?

There are over 200 million firms worldwide. Every one of them is negotiating payment terms with suppliers. Today, however there is no solution that provides insights on what payment terms should be.

Every company is negotiating and setting up payment terms without knowing what each individual supplier is offering to its customers. This leaves millions of free cash flow on the table for an average buying organization – liquidity that can be allocated for R&D, acquisitions, and other growth opportunities.

Who is your solution aimed at? What does your perfect client look like?

Calculum’s ADA Platform is focusing on procurement professionals including CPOs and category managers looking to get insights on how to better negotiate payment terms. The platform is also used by financial professionals such as treasurers to find ways to unlock working capital and generate free cash flow.

Our solution is aimed at companies that are looking at ways to improve working capital , generate cash flow and optimize payment terms. Our platform is used by clients with annual revenue of at least USD 0.5B. Typically, our clients are multinational organizations in manufacturing industries such as Food & Beverage, Automotive, Pharmaceuticals, IT as well as Retail, and Distribution, Telecom and Oil & Gas.

What is the biggest challenge Calculum faces?

The challenge for Calculum is market awareness. Currently, some of the largest organizations in the world are using the Calculum Platform to gain a competitive advantage when negotiating payment terms. However, most organizations and procurement professionals in the market are still not aware that such a solution exists.

Why pick Calculum?

Calculum’s ADA Platform provide specific data points that all our clients are actively using in their negotiation terms. The platform indicates for your individual supplier, what payment terms are offered to other customers (Average, 3rd Quartile, and Maximum Payment Terms). In addition, the platform shows what similar suppliers, selling similar products and services to similar customers are offering as payment terms. This information allows procurement to become more accurate and successful in their negotiations with their suppliers.